WhatDoesItMean.Com

Reports consuming the US propaganda media organs and political elite today are centering upon the charges leveled against the Governor of New York, Eliot Spitzer[pictured top left], and who is said to have paid for the services of a high priced prostitute.

FSB reports circulating in the Kremlin today, however, point to a much more sinister effort behind the toppling of Governor Spitzer as he had just begun a new probe into Larry Silverstein, the owner of the World Trade Center brought down in the September 11, 2001 attacks upon the US, and the Bush Families Carlyle Group.

The focus of Governor Spitzer’s investigation, these reports state, revolve around the growing crisis embroiling the Carlyle Group as it nears total collapse and is facing insolvency due to Larry Silverstone’s withdrawal of over $14 billion from the embattled groups coffers, and which could see the loss to New York States already troubled massive pension fund of over $10 billion.

Governor Spitzer has long battled with the former comptroller for New York States Pension Fund, Alan G. Hevesi, who holds duel Israeli-American citizenship, and prompted a US Federal Probe that charged Comptroller Hevesi of using the over $100 billion of funds entrusted to him for the personal benefit of his friends and family, and to which Mr. Hevesi pled guilty for and paid a $5,000 fine.

Prior to his taking office as New York States Governor, these reports continue, Mr. Spitzer, as a prosecutor, had long targeted the United States Banking System for their vast theft of money from the American people, and had won billions in judgments against Bear Stearns, Credit Suisse First Boston, Deutsche Bank, Goldman Sachs, J.P. Morgan Chase, Lehman Brothers, Merrill Lynch, Morgan Stanley, Salomon Smith Barney and UBS Warburg.

It is more than interesting to note, too, that these are the exact same International Banking Giants who are now reeling under the Global assault against them, with Bear Stearns becoming the latest victim, and as we can read as reported by Britain’s Independent News Service:

"Panic swept the credit markets on reports of an insolvency crunch at both the US investment bank Bear Stearns and the mortgage giant Fannie Mae, triggering a dramatic surge in default insurance and rumours of yet another emergency rate cut by the US Federal Reserve."

As Governor Spitzer becomes yet another victim to vast power of the West’s war, political and media elite assault against him, and by their introduction of sex charges against him, as they have done to so many of their adversaries in order to destroy their credibility, the truest warnings of these events to the American people will no doubt be lost, again.

And, with the most dangerous of these warnings coming from the World’s richest man, Warren Buffet, and as we can read as reported by the Market Watch News Service in their article titled "Buffett and Gross warn: $516 trillion bubble is a disaster waiting to happen", and which says:

"In short, despite Buffett's clear warnings, a massive new derivatives bubble is driving the domestic and global economies, a bubble that continues growing today parallel with the subprime-credit meltdown triggering a bear-recession.

Data on the five-fold growth of derivatives to $516 trillion in five years comes from the most recent survey by the Bank of International Settlements, the world's clearinghouse for central banks in Basel, Switzerland. The BIS is like the cashier's window at a racetrack or casino, where you'd place a bet or cash in chips, except on a massive scale: BIS is where the U.S. settles trade imbalances with Saudi Arabia for all that oil we guzzle and gives China IOUs for the tainted drugs and lead-based toys we buy."

There used to be a time when warnings were prudent to be given to the American people so that they could, in some small measure, protect themselves, but, and sadly, those times are now gone as these people have nearly completed their descent into the abyss of total slavery to their masters with virtually no knowledge of the horrific future that lies before them.

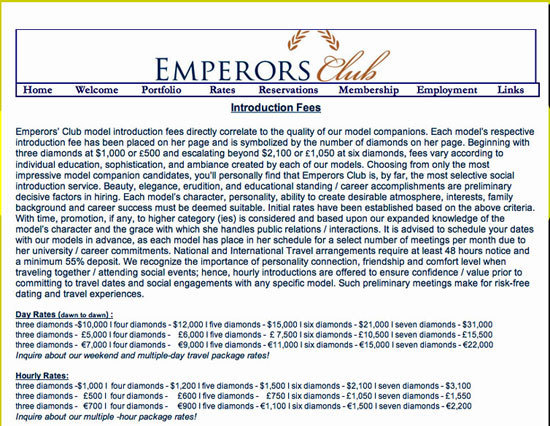

MARCH 10--With the bombshell news today that New York Governor Eliot Spitzer has been implicated in a prostitution ring, the Democratic politician will now always be known as "Client-9," one of the johns described in a recently unsealed FBI affidavit detailing the operation of the Emperors Club, an international call girl ring. That document, an excerpt of which you'll find below, describes hooker interactions with 10 johns, including one client who paid cash for a February 13 rendezvous at a Washington, D.C. hotel. The New York Times, which broke the Spitzer story, has identified the 48-year-old politician as Client-9. As described in the FBI document, Client-9 (clearly a repeat customer) apparently went to great lengths to arrange the illicit Washington encounter, choosing to mail money in advance to the ring, instead of using a credit card. Client-9, whose conversations were recorded by an FBI wiretap, would not do "traditional wire transferring," the affidavit quotes one Emperors Club employee remarking. Additionally, the affidavit notes that after her appointment with Client-9 ended, "Kristen" spoke with a Emperors Club booker, who said that she had been told that Client-9 "would ask you to do things that, like, you might not think were safe..." "Kristen" responded by saying, essentially, that she could handle guys like that.

MARCH 10--With the bombshell news today that New York Governor Eliot Spitzer has been implicated in a prostitution ring, the Democratic politician will now always be known as "Client-9," one of the johns described in a recently unsealed FBI affidavit detailing the operation of the Emperors Club, an international call girl ring. That document, an excerpt of which you'll find below, describes hooker interactions with 10 johns, including one client who paid cash for a February 13 rendezvous at a Washington, D.C. hotel. The New York Times, which broke the Spitzer story, has identified the 48-year-old politician as Client-9. As described in the FBI document, Client-9 (clearly a repeat customer) apparently went to great lengths to arrange the illicit Washington encounter, choosing to mail money in advance to the ring, instead of using a credit card. Client-9, whose conversations were recorded by an FBI wiretap, would not do "traditional wire transferring," the affidavit quotes one Emperors Club employee remarking. Additionally, the affidavit notes that after her appointment with Client-9 ended, "Kristen" spoke with a Emperors Club booker, who said that she had been told that Client-9 "would ask you to do things that, like, you might not think were safe..." "Kristen" responded by saying, essentially, that she could handle guys like that.